#201 2025-04-07 21:04:20

Quite the banner day. Nothing says Mission Accomplished like a parade.

Trump planning military parade through DC for 79th birthday

Washington City Paper first reported on the parade, noting it will stretch almost 4 miles from the Pentagon in Arlington, Va., to the White House.

Offline

#202 2025-04-08 09:08:41

BorderCountess wrote:

I wonder if he realizes that 'past leaders' includes him...

Definitely not, he criticized the people responsible for the current treaty with Canada while either not knowing or not caring that he was the one the who tore up NAFTA and renegotiated with Canada and Mexico.

Offline

#203 2025-04-08 17:57:07

Gotta get down to the Cumberland mines. Make good money 5 dollars a day, made any more might move away.

robots are Secretary Lutnick's vision for America's "manufacturing renaissance"

On Fox News' Hannity on Wednesday, Lutnick touted that "a high school-educated workforce is going to get trained to do robot mechanic," adding that it'll bring the "coolest" and "highest-paying jobs" to the U.S.

"We use robotics here. It's cheaper than cheap labor overseas." He added, "The renaissance will be the greatest factories in the world, high-tech people. What are the jobs Americans are going to have? We are going to have mechanics who fix robotics."

MARGARET BRENNAN: And you said that robots are going to fill those jobs. So those aren't union worker jobs.

SEC. LUTNICK: No, it's really automated jobs. It's automated factories- automated factories. But the key is, who's going to build the factories? Who's going to operate the factories? Who's going to make them work? Great American workers. You know, we are going to replace--

MARGARET BRENNAN: You said robots on other networks. You said that to FOX.

SEC. LUTNICK: --the armies of millions of people- well, remember, the army of millions and millions of human beings screwing in little- little screws to make iPhones, that kind of thing is going to come to America. It's going to be automated and great Americans- the tradecraft of America, is going to fix them, is going to work on them. They're going to be mechanics. There's going to be HVAC specialists. There's going to be electricians, the tradecraft of America. Our high school educated Americans- the core to our workforce, is going to have the greatest resurgence of jobs in the history of America to work on these high-tech factories, which are all coming to America. That's what's going to build our next

Last edited by Johnny_Rotten (2025-04-08 19:47:56)

Offline

#204 2025-04-08 20:39:52

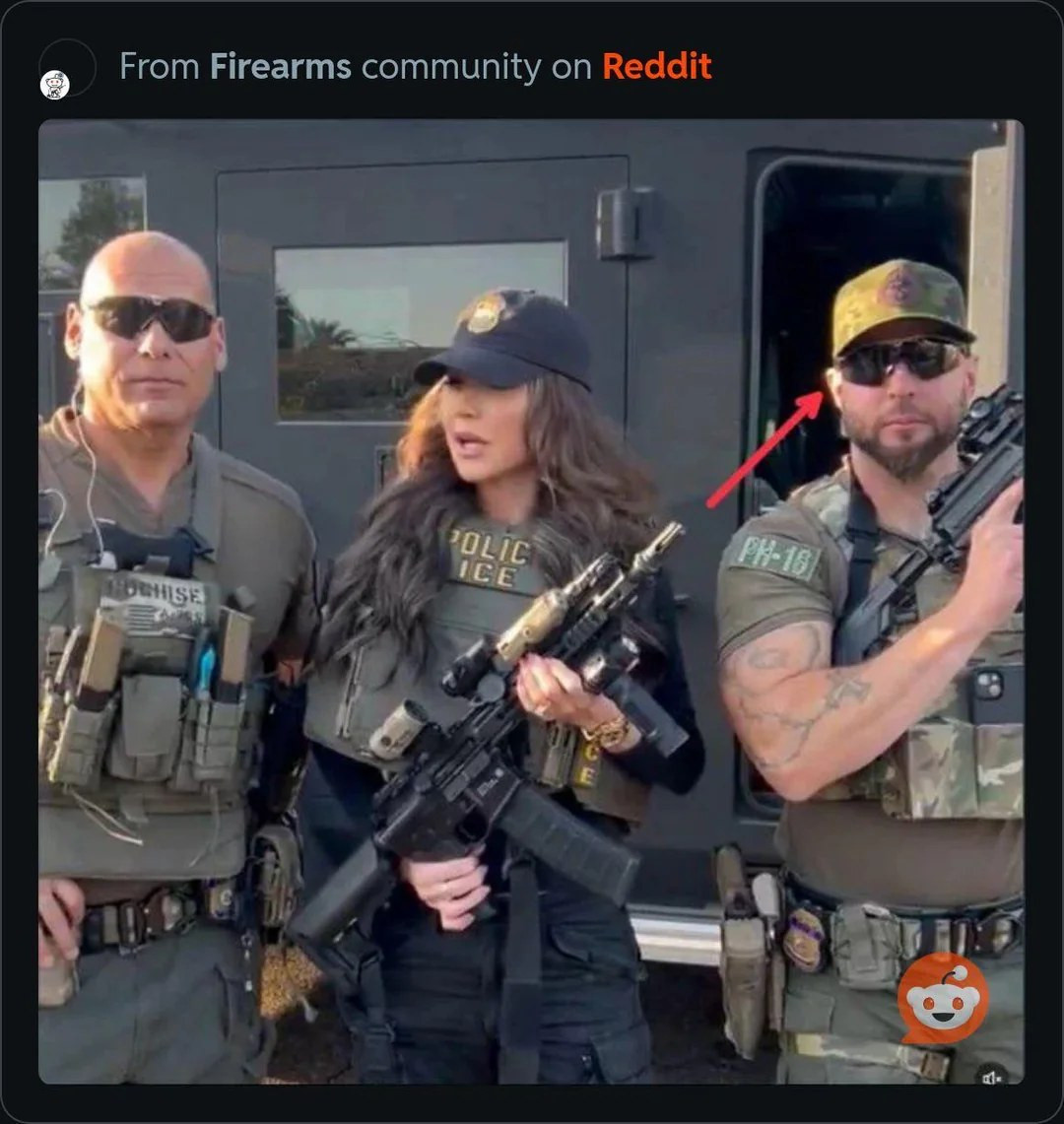

Fucking COS Play... She can shoot dogs, but: Nothing Like Flagging One of the Employees. Maybe she thought the guy was a dog? (edit: if you don't know the reference, ask.)

Offline

#205 2025-04-08 22:30:02

Cosplay Kristi spent way more than that to show her fealty to Trump.

In Your Face: The Brutal Aesthetics of MAGA

Does proximity to power rely on a specific look?

But eventually, as with so many things, the times they are a changing.

Fuller faces—and facial fat grafting—will replace chiseled cheeks.

If your social media feed has ever delivered you to an account that tracks celebrities’ faces over time, you might have noticed common threads in the changes. “It's always: the nose gets more angular, the cheeks get hollower, the cheekbones are more defined. For so long, this has been our beauty ideal,” says Dr. Doft. In the operating room, as well as in the makeup artist’s chair, techniques for sculpting the face have dominated conversations, but their stronghold seems to be slipping: “There was so much talk about buccal fat pad removal [for hollow cheeks], fillers for building up the cheekbones, and contouring with makeup,” says Dr. Doft. “Now we’re getting away from that. Instead of wanting to create shadows on the face and more angularity, we're looking for that fresh, youthful, less defined face.”

Dr. Doft thinks it’s partly a natural ebb and flow—“aesthetics change.” (Just look at the generational divide over winged liner and hair that’s parted to the side.) And it’s partly a reexamining of what’s youthful and, by extension, desirable for many patients. “That fleshier look is associated with youth—I mean, when you look at children, they have full cheeks,” says Dr. Doft. But she also thinks that the more we see sunken faces, the more we’re forced to confront how aging that can be—and it’s not a coincidence that this self-reflection is coming on the heels of so much GLP-1-induced weight loss. “Ozempic face is a really hollow face—we know that it looks drawn, it looks sad, it looks sickly, and so we're trying to combat that,” posits Dr. Doft. “Could this be our natural reaction, pushing back?”

Offline

#206 2025-04-09 03:53:00

"Have I Got News For You" recently did a before-and-after series of women who got 'Mar A Lago' face, and some of them were actually quite good-looking before their... 'enhancements'.

Offline

#207 2025-04-09 19:56:10

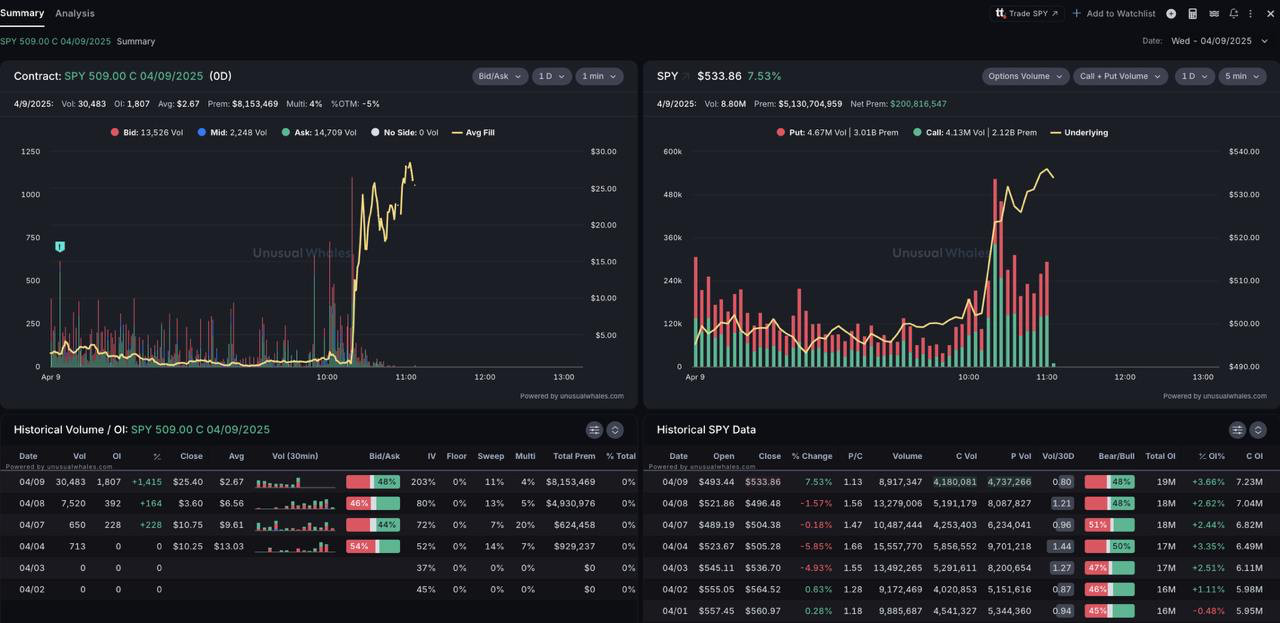

#208 2025-04-09 20:36:54

Back to business as usual.

Trump orders DoJ to investigate duo who debunked claims of election fraud

On Wednesday, Trump, who campaigned with a promise of “retribution”, signed a presidential memorandum accusing Taylor of leaking classified information, stripping him of any active security clearance and ordering the Department of Justice to investigate his activities.

Sitting in the Oval Office, the president said he could barely remember Taylor: “I said, who the hell is Miles Taylor? And he made a living on going on CNN talking about the president. And I think what he did – he wrote a book, Anonymous, said all sorts of lies and bad things. I think it’s like a traitor. It’s like spying.”

Trump added: “I didn’t know anything about him and he wrote a book, Anonymous, and I always thought it was terrible … We’re going to find out whether or not somebody is allowed to do that. I think it’s a very important case and I think he’s guilty of treason, if you want to know the truth, but we’ll find out.”

Taylor responded on social media that Trump had proved his point by using the justice department to pursue revenge. He wrote on X: “I said this would happen. Dissent isn’t unlawful. It certainly isn’t treasonous. America is headed down a dark path. Never has a man so inelegantly proved another man’s point.”

Asked by the Guardian whether he had concerns about his civil liberties were officials to seek to prosecute him, Taylor said in a text message: “Well, if they do that, all Americans should be worried about their own.”

Offline

#209 2025-04-09 22:44:27

#210 2025-04-10 11:00:31

Yeah, I mean, who thought this was anything other than a money grab? Even PolitiFact had our Liar-In-Chief preparing to do a flip flop as "False".

* On April 7, a reporter asked President Donald Trump if he would be open to pausing tariffs to allow for negotiation. Trump said, "Well, we're not looking at that."

* White House Press Secretary Karoline Leavitt said April 7 that the idea that Trump was going to issue a 90-day pause was "fake news."

* On April 9, Trump announced a 90-day pause on some tariffs, lowering the amount for all partners to 10%. He excluded China.

Offline

#211 2025-04-11 21:54:15

A short clear explanation for Trump's mismanagement of the national debt scuttling his plans.

What are bonds and why have they spooked Donald Trump?

The reason the US president had to back down on tariffs once investors started dumping treasury bonds

What have Trump’s tariffs done to bonds?

At first the US president considered his tariff plan to be working, having anticipated stock markets would react badly to tariffs and the dollar would fall.

Trump was sure the bond market would remain calm because he promised to pay for tax cuts later in the year with revenues from tariffs, meaning the US government could limit the number of bonds it issues, keeping supply and demand in sync and putting a cap on overall government debt levels.

However, the tariff war has prompted fears of a US recession, making it riskier to lend to the US. There are concerns that the US will become locked in a titanic struggle with China, which would damage both economies over a long period and drag down global growth.

In response, investors have sold US bonds in huge quantities, driving down their value and sending the yield higher, making future government debt more expensive to issue.

Where did this leave Trump?

There was a fear in the White House that paying a higher interest rate on national debt would increase the government’s annual spending deficit, adding pressure to an already stretched budget and increasing the overall debt mountain.

Worse, the $29tn market in US treasuries is the bedrock of the global financial system and heavy selling could put pressure on other parts of it, forcing banks or other institutions to default and causing a wider financial crisis.

...While Trump has more resources, he faces similar concerns about the spillover effects. If his policies do drive up inflation as expected, with some analysts forecasting a rate of 4.5% by next year, that could alienate the Republican core vote that brought him in on promises to cut soaring food prices. Voters could see tariffs as a tax on mortgages if banks start to charge more for home loans on the back of higher yields, denting his popularity with his base.

Offline

#212 2025-04-14 19:36:33

"Home-growns are next. The home-growns. You gotta build about five more places. It's not big enough."

Aaron Rupar captured and published a rough video conversation on social media.

this exchange was captured on the El Salvador government’s live stream. Trump endorses sending ‘homegrown’ U.S. prisoners to El Salvador—meaning American citizens to notorious foreign prisons.

Follows what he confirms to the press.

“Do you want to pay for those facilities to be open if you want them to be built?” he was asked.

“I’d do something. We’d help them out,” Trump replied. “They’re great facilities, very strong facilities, and they don’t play games. ”

“I’d like to go a step further. I mean, I said it to (Attorney General) Pam [Bondi] I don’t know what the laws are —we always have to obey the laws— but we also have homegrown criminals that push people into subways that hit elderly ladies on the back of the head with a baseball bat when they’re not looking, that are absolute monsters,” Trump added. “I’d like to include them in the group of people to get them out of the country, but you’ll have to be looking at the laws on that.”

Experts have noted that there is no legal way for the president to send legal US citizens to foreign prisons.

Offline

#213 2025-04-14 20:08:24

Johnny_Rotten wrote:

Experts have noted that there is no legal way for the president to send legal US citizens to foreign prisons.

Oh that won't stop Donald, the black van will roll up and they'll just pull you off the street. Next thing you know you're already in El Salvador and your family/friends don't even know you're missing.

Offline

#214 2025-04-15 09:33:04

I know that V For Vendetta was supposed to be social commentary against Thatcher (graphic novel) and Bush (movie), but it's seriously looking more and more like Trump watched it and said, "Hey, let's do that."

Last edited by BorderCountess (2025-04-15 09:33:24)

Offline

#215 2025-04-15 10:33:50

He should have watched to the end, the rats will always turn on you to try and save their own skins.

Offline

#216 2025-04-15 15:25:14

Much like Sutler, I doubt he'd believe it possible until there's quite literally a gun in his face.

Offline

#217 2025-04-22 13:28:27

Sure, it's satire... for now.

Offline

#218 2025-04-24 11:15:21

Concerned about US vaccine misinformation and access, public health experts start Vaccine Integrity Project

By Meg Tirrell, CNN

Updated: 11:00 AM EDT, Thu April 24, 2025

Source: CNN

See Full Web Article

Concerned that the nation’s health leadership is casting unfounded doubt on the safety of well-studied vaccines and may take action to curb their use, a group of public health experts is working to put pieces in place to respond.

The initiative, the Vaccine Integrity Project, will be funded by a foundation backed by Walmart heiress Christy Walton and has a steering committee helmed by former US Food and Drug Administration Commissioner Dr. Margaret Hamburg and former National Academy of Medicine President Dr. Harvey Fineberg, said Dr. Michael Osterholm, who is leading the initiative and who serves as director of the Center for Infectious Disease Research and Policy at the University of Minnesota.

The effort will consider what’s needed to safeguard vaccine policy and use in the US, including whether there’s a need for a new independent body to evaluate vaccine safety and effectiveness, Osterholm said ahead of Thursday’s announcement.

“There have been conversations happening for months now across the public health community about, ‘what will we do if US government vaccine information becomes corrupted or the system that helps to ensure their safety and efficacy are compromised?’ “ he said.

The initiative is being formed in response to actions by US Health and Human Services Secretary Robert F. Kennedy Jr., who has spread mixed messages about the measles vaccine amid a deadly outbreak, accused advisers to federal health agencies of conflicts of interest and pledged to start a major autism study that experts fear will falsely tie the condition to vaccines.

The Vaccine Integrity Project’s first move will be to hold a series of information-gathering sessions, pulling together experts from local public health departments, medical associations, academia, public policy, industry and others.

The initial goal is to determine “what is important to have going forward if, in fact, there should be compromise by the federal government in terms of our vaccine enterprise,” Osterholm said. “We can’t say at this point that that’s happened, but we don’t want to wait until the moment it might happen, and we have enough signals that that is.”

He pointed to Kennedy’s vaccine comments, as well as moves like some Minnesota state legislators’ introduction of a bill this week “to declare that mRNA vaccine technology is a weapon of mass destruction and that it should be immediately taken off the market and anyone using it would be liable for criminal activity.”

“Who’s going to respond to that?” Osterholm asked. “Is anybody at the federal government level going to respond to activities like that? That’s a question I think we are left, at this point, unanswered.”

The “initial feedback phase,” as he called it, will start this month and last until early August.

“We don’t know what’s this is going to look like at the end, but we’ll only find out by listening to all of these groups,” Osterholm said. “At the end of that process, hopefully we can all look at it and come to a similar conclusion, that this is what’s necessary or not necessary to protect the vaccine enterprise.”

Offline

#219 2025-04-27 16:08:37

Wow, looks like we are already skating down easy street. Who knew Trump had it all worked out so well?

Truth Details

5675 replies

Donald J. Trump @realDonaldTrump

When Tariffs cut in, many people’s Income Taxes will be substantially reduced, maybe even completely eliminated. Focus will be on people making less than $200,000 a year. Also, massive numbers of jobs are already being created, with new plants and factories currently being built or planned. It will be a BONANZA FOR AMERICA!!! THE EXTERNAL REVENUE SERVICE IS HAPPENING!!!

Offline

#220 2025-04-28 08:07:38

Of all his childlike peccadilloes, changing the name of something as if he's some kind of master satirist drives me the most crazy. "The external revenue service", what does that even mean? Just like "the senate unselect comittee". I mean, yeah he probably stayed up all night thinking them up. but still.

Offline

#221 2025-04-29 14:54:10

Offline

#222 2025-04-29 14:58:50

Shot over the Bow!

https://newrepublic.com/post/194481/kar … urt-judges

Last edited by SpacePuppy (2025-04-29 14:59:30)

Offline

#223 2025-04-29 18:13:49

SpacePuppy wrote:

Shot over the Bow!

https://newrepublic.com/post/194481/kar … urt-judges

https://cdn.bsky.app/img/feed_thumbnail … lmib4@jpeg

It's not even summer yet. This is beginning to look like 1968 all over again.

Offline

#224 2025-04-30 12:31:12

Fitting this comes on the 50th anniversary of another disastrous war that also had to be waged on people in America.

The US left Vietnam 50 years ago today. The media hasn’t learned its lesson

The myth that news coverage turned Americans against the war persists. In fact, it was largely complicit in perpetuating the conflict

"... how difficult is it to deceive the public? I would say, as a former insider, one becomes aware: It’s not difficult to deceive them. First of all, you’re often telling them what they would like to believe — that we’re better than other people, we are superior in our morality and our perceptions of the world.”

Offline

#225 2025-04-30 14:21:32

Baywolfe wrote:

SpacePuppy wrote:

Shot over the Bow!

https://newrepublic.com/post/194481/kar … urt-judges

https://cdn.bsky.app/img/feed_thumbnail … lmib4@jpegIt's not even summer yet. This is beginning to look like 1968 all over again.

Well I am not up in the mountains training for guerilla warfare like I was in 1968, so I have that going for me.

Offline

#226 2025-04-30 15:11:22

SpacePuppy wrote:

Baywolfe wrote:

SpacePuppy wrote:

Shot over the Bow!

https://newrepublic.com/post/194481/kar … urt-judges

https://cdn.bsky.app/img/feed_thumbnail … lmib4@jpegIt's not even summer yet. This is beginning to look like 1968 all over again.

Well I am not up in the mountains training for guerilla warfare like I was in 1968, so I have that going for me.

You missed all the fun up there! Fortunately for me I was 12 and missed all the fun too, except for Apollo 8.

Offline

#227 2025-05-01 09:39:58

Offline

#228 2025-05-01 16:32:31

#229 2025-05-04 10:08:26

How do you like him now Catholics? Click the "See Full Web Article" link to see the image.

Trump posts AI image of himself as pope, leaving Catholics offended and unamused as conclave nears

By Sophie Tanno, Christopher Lamb and Antonia Mortensen, CNN

Updated: 9:04 AM EDT, Sun May 4, 2025

Source: CNN

See Full Web Article

US President Donald Trump posted an AI image of himself as the pope, prompting accusations of poor taste in the Roman Catholic community just days before the conclave to elect Pope Francis’s successor is due to begin.

Trump, who days prior joked that he would “like to be pope”, posted the digitally doctored image of himself wearing a white cassock and papal headdress, with his forefinger raised, to his Truth Social platform late Friday. It was then reshared by the White House on its official X account.

It came less than a week after Trump, who is himself not a Catholic, attended Francis’s funeral last month. An official period of mourning for the pope is still being observed by the Vatican.

While no one suggests that the image is a serious distraction from the task of choosing the next leader of the world’s 1.4 billion Roman Catholics – Vatican spokesman Matteo Bruni declined to comment on the matter – it has raised eyebrows on social media and drawn criticism, including from cardinals who are in Rome for conclave next week.

“Not funny, Sir,” the 66-year-old Filipino Cardinal Pablo Virgilio David wrote in a post on Facebook.

Cardinal Timothy Dolan, archbishop of New York, was also critical when questioned by journalists ahead of delivering a Mass in Rome on Sunday.

Asked whether he was offended by the image, Cardinal Dolan – who Trump hinted he favors for the next pope - replied, “Well, it wasn’t good.”

Similarly, Father Gerald Murray, a priest of the Archdiocese of New York who was attending the Mass at Cardinal Dolan’s church Sunday, said that Trump’s post was “silly … you don’t do that.”

Italy’s former prime minister, Matteo Renzi, condemned the image as offensive to those of Catholic faith. “This is an image that offends believers, insults institutions and shows that the leader of the right-wing world enjoys clowning around,” he wrote on X.

Trump’s post caught the attention of Italy’s media. “Infantile” was the word used by Italian daily La Repubblica, accusing the president of “pathological megalomania.”

In St. Peter’s Square, CNN asked several groups of American tourists what they thought, and while none wanted to give their names, their reactions ranged from “absurd” to “typical.”

The office of Prime Minister Giorgia Meloni, an international ally of Trump, said they would not comment on the matter.

The image also prompted backlash among Catholic groups in the US. The New York State Catholic Conference, which describes itself as representing bishops in New York, said in a post on X; “There is nothing clever or funny about this image, Mr. President.

“We just buried our beloved Pope Francis and the cardinals are about to enter a solemn conclave to elect a new successor of St. Peter. Do not mock us.”

But the White House defended Trump as pro-Catholic.

“President Trump flew to Italy to pay his respects for Pope Francis and attend his funeral, and he has been a staunch champion for Catholics and religious liberty,” press secretary Karoline Leavitt said when asked to respond to the criticism.

Others in Trump’s circle stressed it was a joke.

“I’m Catholic. We’ve all been making jokes about the upcoming Pope selection all week. It’s called a sense of humor,” far-right activist Jack Posobiec wrote on X.

This is not the first time Trump has triggered controversy with AI-generated imagery. He faced backlash after posting footage imagining war-ravaged Gaza as a Gulf state-like resort featuring a golden statue of himself.

Offline

#230 2025-05-05 00:37:10

In a Truth Social post, Trump said the reopening of Alcatraz — which shuttered on March 21, 1963, having been deemed too expensive to maintain and operate — would “serve as a symbol of law, order and justice.” He directed the Bureau of Prisons, Justice Department, FBI and Department of Homeland Security to work together to reopen the infamous penitentiary on the island.

Offline

#231 2025-05-05 13:54:54

Stupidity piled upon Stupidity...

Offline

#232 2025-05-05 16:50:37

I wonder if anyone's told him that sharing an AI-slop image of himself holding a RED lightsaber isn't the flex he thinks it is...

Offline

#233 2025-05-06 08:20:24

He doesn't know what the Declaration of Independence stands for.

Nor does he know if he has to uphold the Constitution.

Last edited by Baywolfe (2025-05-06 08:24:02)

Offline

#234 2025-05-06 17:06:57

...we're all gonna die.

Offline

#235 2025-05-06 19:25:02

Offline

#236 2025-05-08 11:33:52

Offline

#237 2025-05-08 12:26:26

Offline

#238 2025-05-09 08:41:15

I guess they already owned "the libs" enough already.

Offline

#239 2025-05-17 07:30:11

The Libs will never be owned enough.

Though for some this look like the next step. Personally, I believe the people who brought us reality television, that abomination born out of a writer's guild strike in the 1990s, have a lot to answer for in ruining America.

A Reality Show Where Immigrants Compete for U.S. Citizenship? D.H.S. Is Considering It.

The idea for the reality show was pitched by Rob Worsoff, the Canadian-born producer and writer who worked on Duck Dynasty, a reality TV show about a Louisiana hunting family popular with Trump supporters.

This isn’t The Hunger Games for immigrants,” Worsoff told the Journal, stressing that losing contestants would not face deportation. “This is not: ‘Hey, if you lose, we are shipping you out on a boat out of the country.’”

In an interview, Worsoff told the New York Times that the proposal originated from his own experience with the naturalization process to become a US citizen. Describing the project, he said one of the challenges might center on Nasa to see which participant could assemble and launch a rocket first.

'We'll join in the laughter, tears, frustration, and joy – hearing their backstories – as we are reminded how amazing it is to be American, through the eyes of 12 wonderful people who want nothing more than to have what we have,' the pitch reads.

The immigrants would be divided into teams who'd face off in one-hour episodes.

Scenes envisaged include one in San Francisco, where the immigrants are sent down a mine to collect the most gold

There would also be 'elimination challenges,' where contestants get divided into two groups.

The teams would raft down the Arkansas River in Colorado, dig clams in Maine, put together a chassis for the 1914 Model T Ford on an assembly line in Detroit, and deliver mail via horseback and ferry from Missouri to Kansas.

Although there will be a winner who will become 'our newest fellow American!', Worsoff makes it clear losers will have all been pre-screened for eventual citizenship, so will have a leg-up when it comes to applying for citizenship in the more traditional way.

Game prizes would be 'iconically American,' such as 1 million American Airlines points, a $10,000 Starbucks Gift Card, or a lifetime supply of 76 gasoline.

The live finale would feature the train braking at its final stop, Washington, D.C., where the winner walks to Capitol Hill for a swearing-in ceremony.

As Thunderbird pilots fly overhead, a 'top American politician or judge' will perform the swearing in, read Worsoff's pitch. 'There won't be a dry eye within 10 miles!'

A spokeswoman for the Department of Homeland Security said the agency was happy to review “out-of-the-box pitches.”

Department spokesperson Tricia McLaughlin described the pitch to the New York Times as a “celebration of being an American” and said the show would include challenges based on American traditions.

In a statement, McLaughlin said: “We need to revive patriotism and civic duty in this country, and we’re happy to review out-of-the-box pitches. This pitch has not received approval or rejection by staff.”

Last edited by Johnny_Rotten (2025-05-17 07:40:16)

Offline

#240 2025-05-17 09:19:20

We need to revive patriotism and civic duty in this country

That's how it starts, get the Marching Morons moving in the same direction.

"Imagine a world where treating each other with dignity is a mark of patriotism, a measure of our national well-being and an indicator of future potential."

— Timothy Shriver, Chicago Tribune, 8 May 2025

Offline

#241 2025-05-17 10:00:56

I'm surprised no one's started pitching "Climbing for Dollars" yet. Seems the next logical move.

Offline

#242 2025-05-17 12:31:52

Offline

#243 2025-05-18 06:48:16

"Eat the tariffs."

This feels like tacit acknowledgement that China doesn't pay the tariffs, but ultimately the consumer does.

Offline

#244 2025-05-18 12:11:36

Is this not so much an admission that the consumer must pay as a Trump loyalty test? Please correct me here if wrong. Walmart, and the Walton's in particular, political stance has not been sufficient. The penalty is removal of Trump's cover and support.

Offline

#245 2025-05-19 22:17:44

The damnable thing about all this is Donald is (accidentally) not wrong, Walmart should concern itself with its customers and not its shareholders. All the COVID price gouging never rolled back once we returned to "normal". They just fired a bunch of people they no longer needed, gave themselves all big raises, and just let the share price soar.

Offline

#246 2025-05-22 11:43:50

What’s in Trump’s ‘big, beautiful’ bill that passed the House

By Tami Luhby, CNN

Updated: 11:27 AM EDT, Thu May 22, 2025

Source: CNN

See Full Web Article

The House narrowly passed its massive GOP tax and spending cuts package on Thursday, sending President Donald Trump’s “one big, beautiful bill” over to the Senate, where it will likely face many changes.

The package includes several controversial measures that would deeply cut into two of the nation’s key safety net programs – Medicaid and food stamps – while making permanent essentially all of the trillions of dollars of individual income tax breaks contained in the GOP’s 2017 Tax Cuts and Jobs Act. What’s more, it would fulfill Trump’s campaign promises to cut taxes on tips and overtime, albeit temporarily.

The magnitude of the measures is evident in the estimates of the cost they would incur or the savings they would produce.

The tax changes in the package would add $3.8 trillion to the nation’s debt over a decade, according to a Congressional Budget Office analysis released Wednesday before last-minute changes were made to the bill late that night.

Funding for Medicaid would be slashed by nearly $700 billion, according to CBO, though that figure will likely grow even larger once CBO factors in the late-night update. The food stamps program would see a cut of $267 billion in federal support.

House Republicans included other Trump campaign promises, such as significant investments in staffing at the US southern border, new systems to discourage immigration into the US and a gigantic new missile defense shield. Then there are other longtime GOP policy goals, such as an overhaul of the nation’s outdated air traffic system, new fees targeting electric cars and a pivot away from federal student loans.

Overall, the House was looking for at least $1.5 trillion in spending reductions to offset the legislation’s sweeping tax breaks and investments in defense and immigration control. Senate Republicans are likely to make additional changes, which could soften some of the deep cuts in the House bill.

The Senate also has stricter rules for what can be included since congressional Republicans are pushing the legislation through the budget reconciliation process, so they don’t need Democratic support in the Senate.

CNN is still reviewing the last-minute changes to the legislation.

Here’s what we know about the House GOP package:

Medicaid work requirements

For the first time in Medicaid’s 60-year history, certain recipients ages 19 to 64 would be required to work at least 80 hours a month to retain their benefits. They could also meet the controversial mandate by engaging in community service, attending school or participating in a work program.

The requirement would now take effect by the end of 2026, instead of at the start of 2029. Advancing the date is expected to lead to more people losing their health insurance coverage and to cut more deeply into Medicaid’s federal support.

The mandate would not apply to parents, pregnant women, medically frail individuals and those with substance-abuse disorders, among others.

Republicans have long sought to add work requirements to Medicaid, which provides health insurance to more than 71 million low-income Americans. The first Trump administration granted waivers to several states to implement such a mandate, but the efforts were halted by federal courts.

The new Medicaid work requirements are expected to result in millions of people losing their health care coverage, multiple analyses have shown. While many adults on Medicaid have jobs, they may have trouble meeting the reporting requirements, obtaining exemptions or landing enough hours each month to maintain their eligibility.

The package also mandates states to check Medicaid expansion enrollees’ eligibility every six months, instead of annually, and to require that certain low-income adults covered under Medicaid expansion pay for a portion of their care. Recipients would also have to prove they have US citizenship or legal immigration status.

In addition, the legislation would penalize states that have expanded Medicaid and that provide Medicaid coverage to undocumented immigrants using state funds. These states would see a 10% reduction in their federal matching funds for the expansion population. Several states, including California, New York, Utah and Illinois, cover undocumented children, adults or both in state health plans.

It would also limit states’ ability to levy taxes on health care providers. States use this revenue to boost provider rates and fund health-related initiatives, among other uses. All but one state levy at least one type of provider tax, which some Republicans claim is a scheme by states to get more federal matching funds.

And the legislation includes an incentive for the 10 states that have not expanded Medicaid under a last-minute change. Those states would be permitted to funnel larger supplemental payments to hospitals and other providers, giving the states another reason not to broaden their Medicaid programs to low-income adults. Expansion states would be more limited in the supplemental payments they could send to providers.

The package would postpone implementation of a Biden administration rule aimed at streamlining Medicaid eligibility and enrollment until 2035. Such a delay would make it harder for people to enroll in the program and renew their coverage.

However, the House did not include several other controversial proposals that would have reduced the share of federal funds that states receive.

The bill also calls for codifying a Trump administration proposal that would make changes to the Affordable Care Act enrollment process, including shortening the open enrollment period and eliminating the ability of low-income Americans to sign up year-round.

Plus, in a last-minute change to the bill, GOP lawmakers added a provision to restore funding for federal subsidies that help reduce out-of-pocket costs for lower-income Obamacare enrollees. Trump nixed the funding for the assistance, known as cost-sharing reduction subsidies, in his first term. However, reinstating the cost-sharing subsidies’ funding would likely reduce the generosity of premium subsides for some enrollees, which could prompt them to drop their coverage.

The Medicaid and Affordable Care Act provisions in the package could result in 8.6 million more people being uninsured in 2034, according to an early CBO estimate released by Democratic lawmakers. That number is expected to grow with the latest changes.

Larger child tax credit

The child tax credit would rise to $2,500, up from $2,000, per child from 2025 through 2028. Single parents earning up to $200,000 and married couples earning up to $400,000 qualify. The credit phases out for those with higher incomes.

Also, the legislation would require that parents, in addition to the child, have Social Security numbers. Currently, parents can claim the credit if they have individual taxpayer identification numbers, which some noncitizens who are not eligible for Social Security numbers use to file federal taxes. The change would mean 2 million fewer children would be eligible next year, according to the JCT.

Trump accounts for kids

The package would create a new “money account for growth and advancement,” or MAGA account – which House lawmakers renamed “Trump accounts.” The federal government would provide a one-time $1,000 credit to the accounts of children born from 2025 through 2028 who are US citizens at birth.

The annual contribution limit to the tax-preferred accounts would be $5,000, and money could not be withdrawn before the beneficiary turns 18. After that, the funds could be used for higher education or a first-time home purchase, among other purposes, and taxed at capital gains rates. After a beneficiary turns 31, the account would cease to be a Trump account.

No taxes on tips and overtime

Certain taxpayers would be able to deduct the income they receive from tips on their tax returns, fulfilling a key Trump campaign promise, under the proposal.

But it would only apply to occupations that traditionally receive tips, in an effort to prevent employers and workers from recharacterizing their income as tips to escape taxes. The Treasury secretary would be tasked with publishing a list of such jobs.

Highly compensated individuals, who make more than $160,000 in 2025, would not qualify. The deduction would apply to 4 million tipped workers, according to a fact sheet from Rep. Jason Smith, chair of the House Ways and Means Committee.

Likewise, many hourly employees who receive overtime would not have to pay taxes on that extra compensation. It would apply to 80 million hourly workers, according to Smith. Those who are highly compensated would not qualify.

Both breaks would be available to taxpayers who do not itemize their deductions, who are the majority of Americans. However, the measures would only be in effect from 2025 through 2028.

A boost for senior citizens

Senior citizens would receive a $4,000 increase to their standard deduction from 2025 through 2028, according to the package. But the benefit would start to phase out for individuals with incomes of more than $75,000 and couples with incomes double that amount.

This measure is aimed at fulfilling Trump’s promise to end taxes on Social Security benefits since lawmakers cannot include such a measure under the rules of budget reconciliation, which Republicans are using to advance the package without Democratic support in the Senate.

Car loan interest deduction

The legislation calls for a new temporary deduction for the interest on car loans, in keeping with Trump’s campaign promise.

Eligible taxpayers could deduct up to $10,000 in interest annually from 2025 through 2028. But the tax break would start to phase out for single filers earning more than $100,000 and married couples earning $200,000.

It applies to taxpayers who get car loans starting in 2025 and who buy passenger vehicles that had their final assembly in the US.

More tax breaks

The package would temporarily boost the standard deduction by $1,000 for single filers and $2,000 for married couples.

And it includes some measures that would benefit wealthy Americans. It would make permanent the larger estate tax exemption, which would be set at $15 million per person for 2026 and would be indexed to inflation thereafter.

Plus, it would make permanent a special deduction for the owners of certain pass-through entities who pay their business taxes on their individual tax returns. It would beef up that deduction to 23%, up from 20%. These so-called pass-through businesses include partnerships, such as those formed by lawyers, doctors or investors.

State and local tax deductions

The latest version of the bill would also hike the current limit on state and local tax deductions to $40,000 annually, up from $10,000. But the full amount would be limited to those making $500,000 or less, before it starts to phase back down to $10,000.

The beefed up cap, which would rise gradually over time, would last until 2034.

Republican lawmakers from high-tax states, including California and New York, had been demanding an increase to the so-called SALT cap for years since it disproportionately hits their constituents. The limit mainly affects higher-income residents in those states.

Republicans introduced the cap as part of their 2017 tax cuts package as a way to help pay for the sweeping legislation. Trump had promised to eliminate the cap on the campaign trail last year, but doing so would be very costly.

Business tax breaks

The package would restore a tax break from the 2017 tax package that allowed businesses to fully write off the cost of equipment in the first year it was purchased. The incentive has been phasing out since 2023.

Also, the legislation would once again allow businesses to write off the cost of research and development in the year it was incurred. The TCJA required that companies deduct those expenses over five years, starting in 2022.

The two provisions would expire after 2029.

The bill would also temporarily allow companies to immediately deduct the cost of constructing or making improvements to certain types of buildings, including manufacturing plants.

However, the package would limit writing off the purchases of professional sports teams.

Higher taxes for universities and foundations

Some universities currently pay a 1.4% tax on the net investment income from their endowments. The bill calls for raising that rate to as high as 21%, depending on the endowment’s size.

Similarly, private foundations would see their tax rate jump to as much as 10%, up from roughly 1.4%.

Raising the debt ceiling

The legislation would also raise the debt ceiling by $4 trillion.

Congress needs to raise the debt limit before its August recess to prevent the nation from defaulting on its obligations, Treasury Secretary Scott Bessent wrote to lawmakers last week.

Expanded work mandate for food stamps

Under the package, more food stamp recipients would have to work to qualify for benefits.

Currently, adults ages 18 to 54 without dependent children can only receive food stamps for three months over a 36-month period unless they work 20 hours a week or are eligible for an exemption.

The legislation would extend the work requirement to those ages 55 to 64, as well as to parents of children between the ages of 7 and 18. Plus it would curtail states’ ability to receive work requirement waivers in difficult economic times, limiting them only to counties with unemployment rates above 10%.

The bill would also require states to pay for a portion of the benefit costs – at least 5% – for the first time, starting in fiscal year 2028. States with higher payment error rates would have to shoulder more of the burden – as much as 25% of the costs for those with error rates of at least 10%.

Plus, states would have to pick up 75% of the administrative costs, rather than 50%.

Advocates quickly criticized the proposals, saying recipients could lose crucial food assistance and states would be on the hook for millions of dollars, which could lead them to cut benefits and eligibility.

Some 42 million Americans are enrolled in the Supplemental Nutrition Assistance Program, or SNAP, the formal name for food stamps.

Clean energy programs axed

The legislation would effectively deal a blow to the Inflation Reduction Act, former President Joe Biden’s major clean energy law passed in 2022.

In last-minute changes, Republicans sped up the timelines for phasing out key clean energy tax credits to the end of 2028. They also put in a new, narrow set of requirements for energy companies building solar, wind, battery or geothermal to generate electricity, only allowing companies to recoup the credit if they started construction within a 60-day window after the bill was signed into law, and their power was in service by the end of 2028.

Analysts have also said the move will increase Americans’ electricity bills, since it would prevent cheaper wind, solar and batteries from getting on the grid at the same time power-hungry data centers and AI are coming online.

The only carve-out was for nuclear energy, a form of clean energy touted by Trump and Republicans that is much more expensive and time-intensive to build than solar and wind. Nuclear companies could claim a tax break if they started construction by 2028.

The package also claws back unspent IRA funds, targeting a $27 billion grant program at the Environmental Protection Agency and other EPA and Energy Department programs.

Republicans ultimately stripped a provision of the bill that would have sold off 500,000 acres of public land in Utah and Nevada, a measure that was opposed by some Western Republican lawmakers.

Federal student loans

The legislation would dramatically restructure the way students can borrow from the federal government for college, as well as make big changes to the popular Pell grant program.

The package, which CBO projects would save about $350 billion over a decade by limiting the federal role in the student borrowing process, would cap the total amount of federal aid a student can receive annually at the “median cost of college” and end economic hardship and unemployment deferments. Plus, it would bar loan servicers from temporarily suspending student loan payments for more than nine months over a two-year period.

The changes also include terminating the subsidized loan program for undergraduate students and the Graduate PLUS loan program for new borrowers, with a three-year exception for students with such loans. The bill would amend the maximum annual and aggregate loan limits for unsubsidized loans, as well as require undergraduate students to exhaust their unsubsidized loan options before their parents can take out Parent PLUS loans.

In addition, the legislation would terminate all income-contingent repayment plans — including Biden’s SAVE plan, which has been blocked in federal court. Instead, borrowers would have a choice of a standard repayment plan or a repayment assistance plan based on borrowers’ income.

The bill also calls for alterations to the Pell grant program, including requiring students attend school at least half time and increasing the number of credit hours needed for full-time enrollment. But it would expand eligibility for such grants for students enrolled in short-term workforce programs.

And the legislation would create “skin-in-the-game accountability” for colleges participating in the Direct Loan program by requiring them to reimburse the Department of Education for a portion of loans that aren’t fully repaid.

It would also establish a “Promise” program to provide colleges with performance-based grants of up to $5,000 per federal student aid recipient. The colleges must provide students with a guaranteed maximum total price for their program of study based on income and financial needs categories. The formula would reward institutions for strong earnings outcomes, low tuition, and enrollment and graduation of low-income students.

Immigration fees and ICE funds

Immigrants applying for asylum and work authorization, as well as those applying for humanitarian parole and temporary protected status, would have to pay new or higher fees, under the package.

Asylum seekers and parolees would have to pay $1,000 to apply and $550 for an initial work permit, for instance. Plus, sponsors of unaccompanied children would have to pay up to $3,500.

The bill also provides $45 billion to build new immigration detention facilities, including family detention centers, to allow the detention of at least 100,000 people a day, on average. It supports hiring 10,000 more Immigration and Customs Enforcement officers, including money for retention and signing bonuses for the agents, and provides funding for 1 million annual deportations through ground and air transportation.

And it provides $1.3 billion to hire immigration judges and support staff, as well as to expand courtroom capacity.

Border security

The legislation calls for tens of billions of dollars to bolster border security, including $46.5 billion to expand and modernize the border barrier system. Planned investments include the completion of 700 miles of primary wall, the construction of 900 miles of river barriers, and the replacement of 141 miles of vehicle and pedestrian barriers.

The package would also provide $5 billion to acquire, construct or improve Customs and Border Protection facilities. Plus, it would funnel $4.1 billion for the agency to hire and train 3,000 new Border Patrol agents, 5,000 new Office of Field Operations customs officers, 200 new Air and Marine Operations agents, 290 support staff, and eligible retired agents and officers. It would also invest $2 billion in annual retention bonuses and signing incentives.

The bill would provide nearly $1.1 billion to strengthen technology to detect and disrupt the smuggling of illegal drugs and people into the US, and $2.7 billion for border surveillance technology, including tunnel detection capability and unmanned aircraft systems.

And it includes $1 billion for security and planning for the 2028 Olympics in Los Angeles, as well as $625 million for the 2026 FIFA World Cup, which will be hosted by the US, Canada and Mexico. It would also provide $300 million for the Federal Emergency Management Agency for the reimbursement of extra law enforcement costs for protecting presidential residences.

Electric and hybrid vehicle fees

Electric vehicles would have to pay an annual registration fee of $250 and hybrid vehicles would be assessed an annual fee of $100, under the package. The funds would be deposited into the Highway Trust Fund.

But a proposal to levy a $20 annual tax on gas vehicles was dropped, after it faced swift pushback from conservatives.

The legislation would also eliminate seven green programs authorized by the Democrats’ 2022 Inflation Reduction Act, including the Low-Carbon Transportation Materials Grants Program and the Federal Aviation Administration’s Alternative Fuel and Low-Emission Aviation Technology Program.

Air traffic control

The bill would appropriate $12.5 billion for the modernization of the nation’s air traffic control system. The funds would begin replacing outdated technology and enhance the hiring of air traffic controllers.

Financial company oversight

The package would limit the embattled Consumer Financial Protection Bureau’s authority to draw funds from the Federal Reserve. Also, it would essentially eliminate the Public Company Accounting Oversight Board, which was established by Congress to oversee the audits of public companies, by shifting its responsibilities to the Securities and Exchange Commission and barring it from collecting fees from companies and brokers and dealers.

Defense

The legislation calls for adding roughly $150 billion to strengthen the nation’s defense programs.

The package includes nearly $25 billion for Trump’s “Golden Dome” missile defense initiative, which calls for developing a space-based system and quickly accelerating defense capabilities against hypersonic threats. It would provide nearly $34 billion for ship building and more than $20 billion for munitions, including ramping up the domestic production of rare earth and critical minerals.

Also, the bill would funnel more than $8.5 billion to improving service members’ quality of life, including renovating military barracks, providing supplemental payments of the Basic Housing Allowance, expanding educational opportunities and child care fee assistance, and broadening professional licensure assistance programs for military spouses.

Judges’ power to hold Trump administration in contempt

The package would defund the enforcement of contempt orders if the judge had previously not ordered the plaintiffs in the case to put up a security bond with a preliminary injunction or temporary restraining order granted in their favor. The goal is to stop frivolous lawsuits, according to a committee spokesperson.

Impact on the deficit

Although the package includes deep reductions in spending, its tax cuts would slash revenue even more, according to several independent analyses. CBO has yet to release an official score of the entire bill.

A preliminary estimate from the Committee for a Responsible Federal Budget said the legislation would add $3.3 trillion to the nation’s debt over the next decade. And annual deficits would jump from $1.8 trillion in 2024 to $2.9 trillion by 2034 as the federal government would continue to spend more than it would raise in revenue, the committee projected.

Similarly, the Penn Wharton Budget Model also found that the package would cost $3.3 trillion over 10 years. It noted that the tax proposals would reduce revenue by $4.6 trillion, while spending on defense, homeland security and immigration enforcement would add more than $300 billion. But the savings in the bill only amount to $1.6 trillion.

These estimates were released before House Republicans updated the bill ahead of a floor vote.

Some House Republicans are downplaying the legislation’s impact on the deficit, arguing that the enhanced economic growth spurred by the package will bring in more revenue. White House press secretary Karoline Leavitt on Monday told reporters, “This bill does not add to the deficit.”

This story has been updated with additional developments.

© 2025 Cable News Network. A Warner Bros. Discovery Company. All Rights Reserved.

Offline

#247 2025-05-22 18:46:40

There's a lot of words there, and I assume it's pretty much all horrible shit, but this jumped out at me:

It would make permanent the larger estate tax exemption, which would be set at $15 million per person for 2026 and would be indexed to inflation thereafter.

So, they're willing to index the estate tax exemption to inflation, but not the minimum wage. Got it.

Offline

#248 2025-05-22 19:33:41

Offline

#249 2025-05-23 15:12:53

Offline